Holidays and risky driving behaviors can impact risk profiles

The 2021 holiday season travel predictions are in. AAA predicted that 48.3 million travelers will have hit the roads over the Thanksgiving holiday – up more than 8% over last year and about 3.5% below 2019 numbers. Also during this time, the National Safety Council estimated that 515 fatalities may occur, the largest number of deaths since 2007. As we head into the extended holiday season – December through the first week of January – risky driving behaviors will likely continue to rise as more people are on the roads beyond the traditional commute hours. With that in mind, what impact can you expect to see on your risk profiles post-holidays?

Early 2021 data sets the stage

In October, the National Highway Traffic Safety Administration (NHTSA) released its Early Estimate of Motor Vehicle Traffic Fatalities for the First Half (January–June) of 2021. Their statistical projections estimate that more than 20,000 people died in motor vehicle crashes on U.S. roads, a nearly 20 percent increase from the same period in 2020. This represents the largest increase ever recorded in NHTSA’s reporting history during a six-month period.

The summary linked above also provides some preliminary data from the Federal Highway Administration that shows miles driven in the first half of 2021 has largely rebounded to pre-COVID numbers. But the how and when these miles are driven look different than before 2020. Two years into the pandemic – and with a majority of full time workers in the United States still working from home – the daily commute has changed. The number of commuters on the roads in the morning are down, and up during the afternoon/evening commute. Assuming many evening drivers could be out at these times for holiday events and shopping, you could be seeing a change to your customers’ risk profiles.

Could working from home result in more miles driven?

Earlier this year, David Zipper at Slate asked “What if Working at Home Makes Us Drive More, Not Less?” Some great points were made in his article to suppose that remote work could lead to as much driving as before the COVID-19 pandemic office shutdowns. A hypothetical consumer, who used to commute a set number of miles to and from work each day now works from home and runs her errands during the day. Could this continued teleworking contribute to more miles driven – and increased risk – as workers trade a consistent commute distance with frequent errands during the day, including holiday shopping, to avoid weekend crowds? Let’s take a look at the data…

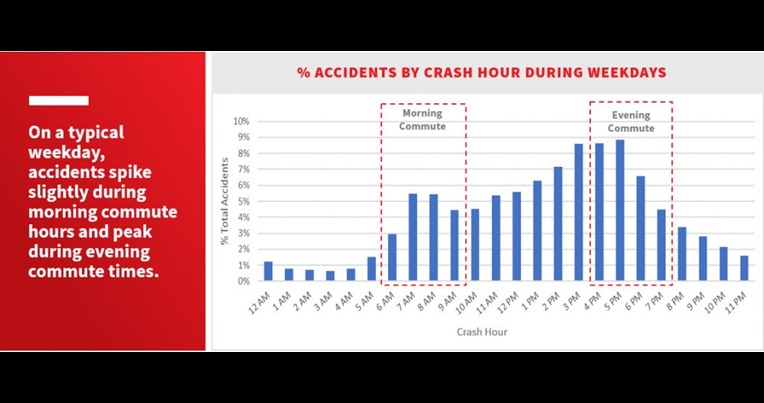

Internal LexisNexis Risk Solutions data from 2018 to 2021 shows that during a typical weekday, car crashes spike slightly during morning commute hours (7-9 a.m.) and then climb during the afternoon hours and peak during the evening commute. (Figure 1)

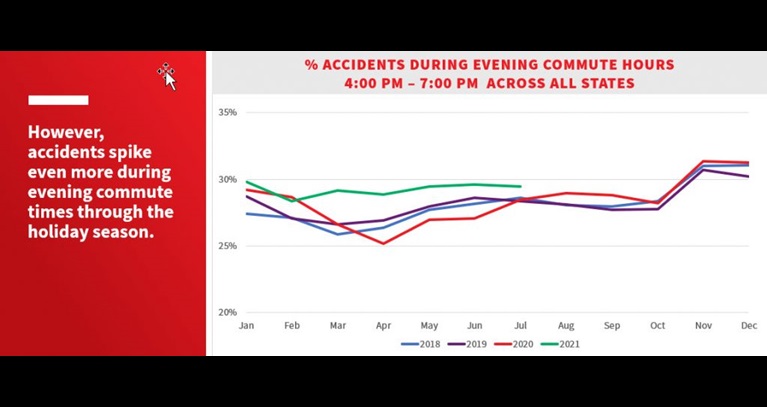

LexisNexis Risk Solutions internal data also shows a spike in accidents during the evening commute times (4-7 p.m.) in November and December. (Figure 2) An assumption can be made that remote workers are running errands throughout the latter part of the workday, leading to an increase in accidents. With brick-and-mortar holiday sales predicted to rise 7.9% in 2021, it’s possible that this trend will continue.

During the holiday season, people are taking more time off from work, attending family and friends’ get-togethers, going to holiday parties and more. Thus, the roads this time of year can prove treacherous for all drivers. Paying attention to your data and getting a complete picture of a driver’s risk can help you make better business decisions and protect your bottom line.

We will continue to monitor our robust driving data to bring you updates and insights as we identify changes impacting your insureds and your business. Accurate and comprehensive data assets can help you get a clearer, more comprehensive view of the factors influencing change to risk, so you can better assess and manage your risk, as well handle claims more efficiently and provide the best service to your customers. For more information about our auto insurance data solutions, please call 800.458.9197 or email insurance.sales@lexisnexisrisk.com.

Also check out the findings from our latest study titled The True Impact of ADAS Features on Insurance Claim Severity Revealed, with useful implications for insurance rating and loss costs.